Nick Goold

New Thriving in the Copy Trading World: A Guide to Sustainable Profits Article

Copy trading has emerged as a popular strategy where individuals can mimic the trading actions of experienced traders, aiming to replicate their success. While this approach has brought success to many, some notable pitfalls and misconceptions can stymie progress. This article explains the stumbling blocks you might encounter in your copy trading journey and how to navigate them for a profitable trading experience.

Navigating the Challenges: Understanding Why You Might Not Be Profiting

There are numerous reasons why individuals find it challenging to turn a profit through copy trading. Some of these include:

A Hasty Beginning: The Importance of Slow and Steady Progress

Starting your copy trading journey expecting quick profits can set you up for disappointment. It's essential to begin with a measured pace, gradually gaining experience and understanding of the strategies adopted by successful traders. This cautious approach allows you to build a solid foundation and make informed decisions in the long run.

Unrealistic Expectations: The Fallacy of Everlasting Profits

Believing that a trader will continuously yield profits is a misconception that needs to be dispelled. The reality is that markets fluctuate, and even the most seasoned traders experience highs and lows. Your focus should be on identifying traders who can adeptly modify their strategies in response to market changes, maintaining a trajectory of long-term profitability rather than transient success.

Overlooking Points of Caution

Awareness of potential pitfalls and approaching copy trading with a cautious mindset is vital. Here are some points to be wary of:

- Monolithic Strategy: Avoid investing your entire account in following a single trader. Diversifying by following different traders can help mitigate risks and provide a more balanced portfolio.

- Past Performance as Sole Criterion: Past performance can offer insights, but it shouldn't be the only factor influencing your decisions. Remember, it does not guarantee future success.

- Blind Following: It is essential not to follow a trader mindlessly without understanding their strategy. Endeavour to grasp the nuances of the methods employed, instilling greater confidence in your choices.

How to start Copy Trading safely

Initially, one should prioritize acquiring a foundational understanding of the financial markets and the mechanisms of copy trading. New entrants are encouraged to start with demo accounts where they can practice without any real financial risk, gaining a foothold in the dynamics of market trends and strategies employed by seasoned traders. This phase allows individuals to learn without the pressure of potential financial losses, fostering a safe environment to nurture one's skills and strategies.

Furthermore, a prudent approach to initiating your copy trading journey involves meticulously selecting a reliable and reputable platform. These platforms should adhere to regulatory standards and offer adequate investment protection. When selecting a trader to follow, it is wise not to put all your eggs in one basket. Diversifying your investments by following multiple traders with distinct trading styles and asset focus can help mitigate risks.

Moreover, it's crucial to maintain a vigilant eye on your portfolio, ready to make adjustments based on market dynamics. Remember, the hallmark of a safe start in copy trading is a well-rounded approach, combining education, careful selection of traders, and continuous monitoring to foster a resilient and potentially profitable investment journey.

Strategies for Enhancing Your Copy Trading Journey

As you delve deeper into the world of copy trading, adopting certain strategies can fortify your journey towards sustainable profitability:

Educational Commitment

Commit yourself to learning the intricacies of the market and the strategies employed by the traders you are following. This educational foundation will be your pillar of strength, helping you make well-informed decisions.

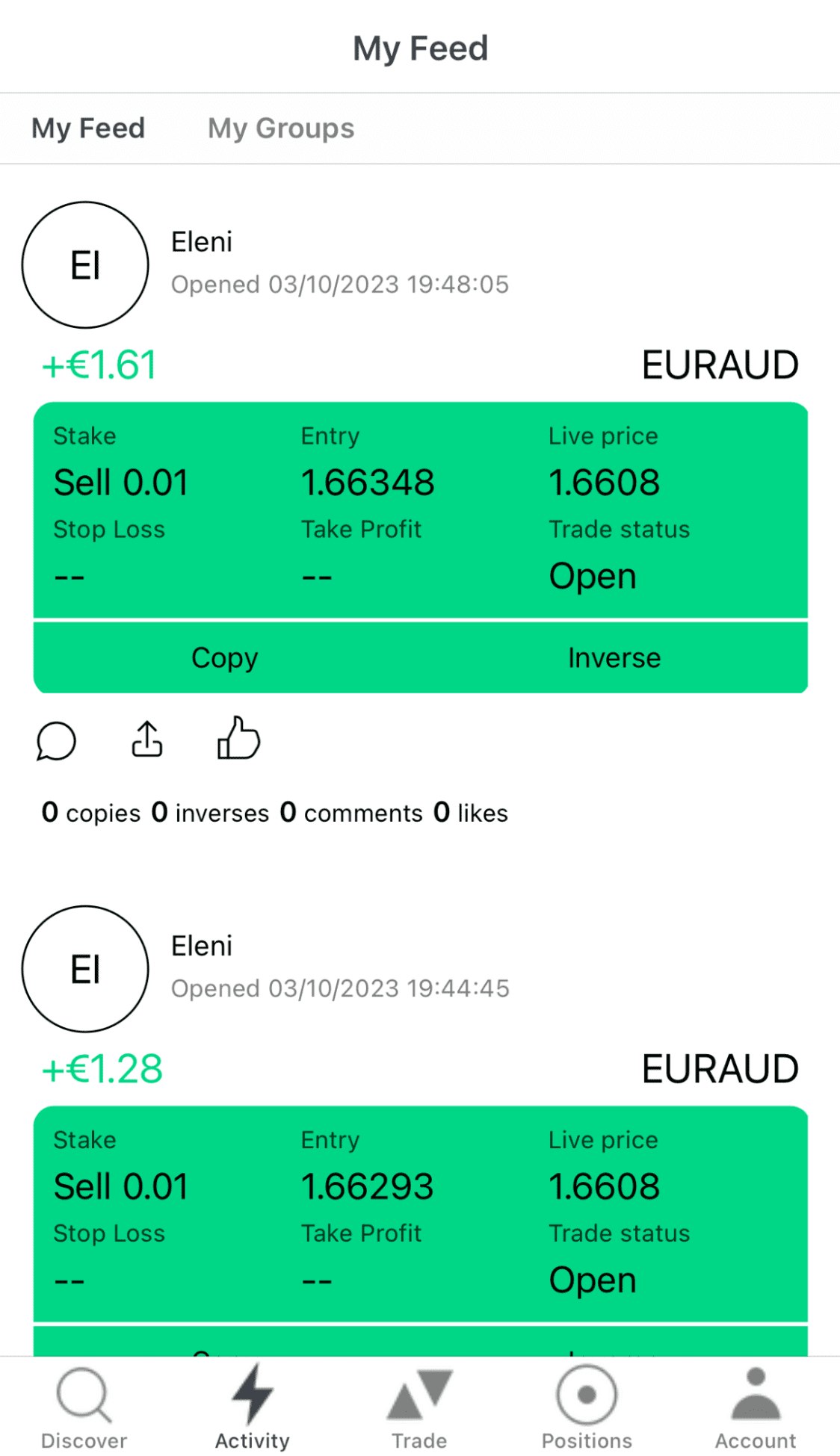

Before you copy traders with the TitanFX Social app you can track other traders trades and results to improve your trading knowledge.

Using the TitanFX Social app, you can monitor the trades and outcomes of other traders to enhance your trading expertise before opting to copy them.

Please note we are not recommending this trader, please do your own research.

Legal Compliances and Safety Measures

Understanding the legal aspects of copy trading is crucial. Before you start, ensure that you are well-acquainted with the legal framework and adhere to safety protocols to prevent potential fraud and scams.

Seeking Adaptable Traders

Opt for traders who have proven their ability to adjust their trading systems in alignment with changing market dynamics. These traders are more likely to sustain profitability in the long run, offering a safer harbour for your investments.

Emotional Equanimity

Copy trading can be a rollercoaster of emotions, especially when markets are volatile. A calm disposition can help avoid impulsive decisions, allowing you to focus on rational, data-driven choices.

Technological Competency

Enhance your understanding of the technological aspects of copy trading. Being proficient in utilizing technology to your advantage can yield higher returns.

Conclusion

Embarking on a journey into the world of copy trading necessitates a well-rounded approach, combining the right selection of traders to follow with a learning-oriented mindset. A cautious approach and a focus on long-term profitability and skill development can pave the way for a successful copy trading experience. Remember, the ultimate goal is to foster a sustainable and profitable trading journey, steer clear of gambling, and focus on long-term financial growth.

Related Copy Trading Articles

- Copy Trading Guide 1: How to start copy trading as a follower?

- Copy Trading Guide 2: The Benefits of Copy Trading at Titan FX

- Copy Trading Guide 3: How to Start Copy trading with Titan FX?

- The Downsides of Copy Trading: How to Sidestep Common Pitfalls

- New Thriving in the Copy Trading World: A Guide to Sustainable Profits Article