Nick Goold

The Downsides of Copy Trading: How to Sidestep Common Pitfalls

Copy trading, a strategy where individuals can mirror the transactions of expert traders comes with its fair share of challenges. While it promises convenience and profit potential, there are several downsides to be wary of. This article explores these demerits in-depth and provides strategies to avoid them.

It is challenging to identify traders with good performance

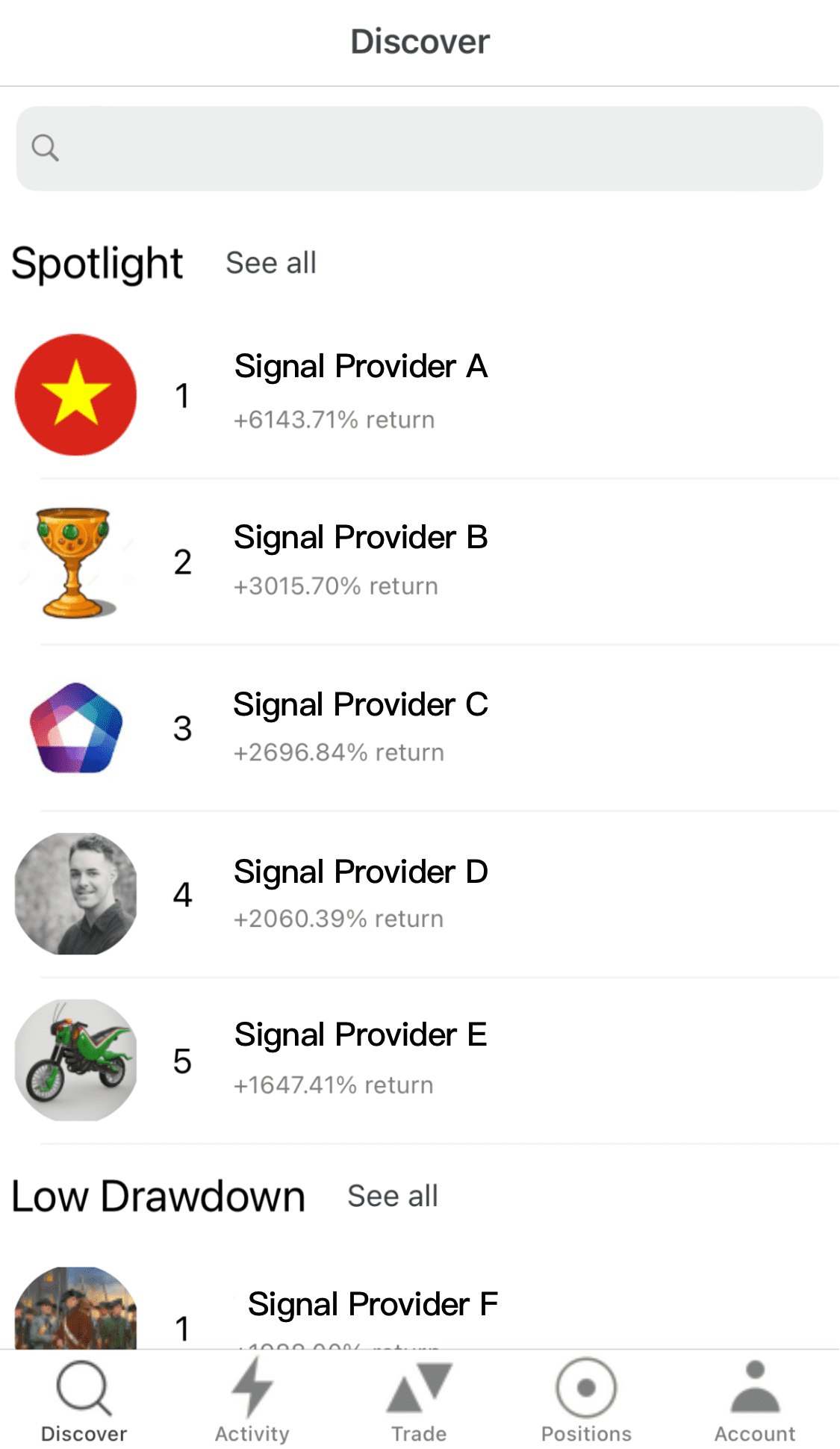

One of the most notable challenges is identifying traders who consistently perform well. Many platforms will showcase traders with the best performance, but these figures sometimes result from short-term luck rather than a sustainable strategy. It becomes vital to scrutinize the historical performance, risk management strategies, and the sustainability of the profits made by a trader before deciding to follow them. You can start following a trader with a small live position and increase your position size as you become more confident in the strategy.

By checking the TitanFX Social scoreboard you can easily check the performance of different traders:

There is a risk that a trader may suddenly stop trading

There exists a risk of a trader abruptly discontinuing their trading activities. This risk can be mitigated by following multiple proficient traders simultaneously. This strategy secures continuous trading activity and helps diversify the risk and enhance returns.

Limited Learning Opportunities

While copy trading is convenient, it only contributes a little to your learning curve as a budding trader. To counter this, you can consider parallelly engaging in trading educational courses. Analyzing the strategies of the traders you are following and trying to understand the rationale behind their trades can also be an excellent way to enhance your trading skills.

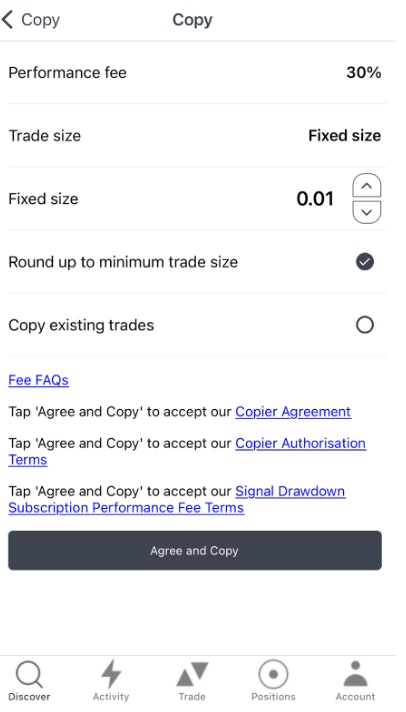

Copier Fees: Managing Contingency Fees

One of the downsides of copy trading is the necessity to pay contingency fees, which can sometimes eat into your profits. Knowing all the potential charges and calculating the net returns after accounting for these fees is essential. This will help in setting realistic profit expectations.

Within the TitanFX Social app you can easily check and compare the fees for the different signal providers.

Handling Emotional Fluctuations

Even though copy trading is supposed to minimize emotional trading decisions, it isn't entirely devoid of emotional undertones. Followers might find themselves experiencing stress and anxiety, especially during volatile market conditions. It's crucial to develop a mindset that can handle the emotional rollercoaster associated with trading, possibly by seeking guidance from a trading psychologist.

Preventing Technology-induced Setbacks

As with any online platform, copy trading can sometimes be hampered by technology issues, ranging from server downtimes to glitches in the trading software. Having a backup plan and being prepared to manually manage your trades during such downtimes can help. It is also beneficial to be affiliated with platforms that offer excellent customer support to resolve issues swiftly.

By being aware of these demerits and actively working towards avoiding them, you can potentially have a smoother and more profitable copy trading experience. Remember, the key to successful trading lies in maximising profits and adeptly managing the associated risks and challenges.

Related Copy Trading Articles

- Copy Trading Guide 1: How to start copy trading as a follower?

- Copy Trading Guide 2: The Benefits of Copy Trading at Titan FX

- Copy Trading Guide 3: How to Start Copy trading with Titan FX?

- The Downsides of Copy Trading: How to Sidestep Common Pitfalls

- New Thriving in the Copy Trading World: A Guide to Sustainable Profits Article